3 mins

![[object Object]](https://images.ctfassets.net/qqwro44pe5rn/3vF6XcPnRAMhQqsWFPNN4Y/bc63d1e1b80d598f6164cd327501c5ed/Kenny_McKay_thumbnail_small.png?w=60&h=60&fit=fill&fm=webp)

Kenny McKay, Wealth Planner

It’s understandable to question whether you should move your money into cash or stay invested. But time and again, evidence shows that sticking with your investment strategy tends to deliver better results in the long run.

Why trying to time the market rarely works

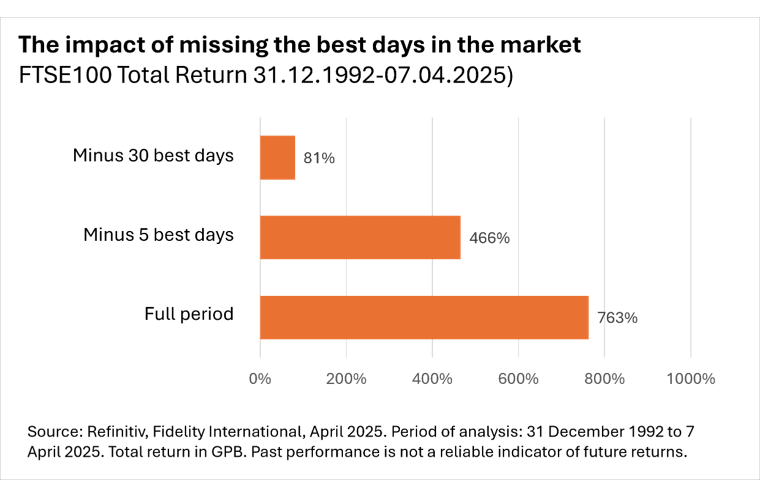

Trying to move in and out of the market at the right time rarely works in practice. Some of the strongest gains often happen during short, sharp recoveries, and missing just a handful of those days can have a lasting impact. In fact, missing even the best 5 days over a 30-year period can significantly reduce your overall returns.

How spreading your investments helps

One of the benefits of working with a financial adviser is knowing your investments are already well balanced. A carefully diversified portfolio, designed to spread risk across different areas, can help smooth out returns over time. It also means you’re better placed to stay invested through market ups and downs, without needing to make knee-jerk decisions.

Remaining invested may be an emotional rollercoaster during times of market stress, but research shows time and again that this is the best investment approach over the long term.

The hidden cost of holding on to cash

When markets fall, it’s easy to feel unsure about what to do next. Many investors are tempted to move into cash and wait for a ‘better time’ to reinvest. But this approach often means missing out on some of the strongest market days – and those can make a big difference to long-term returns.

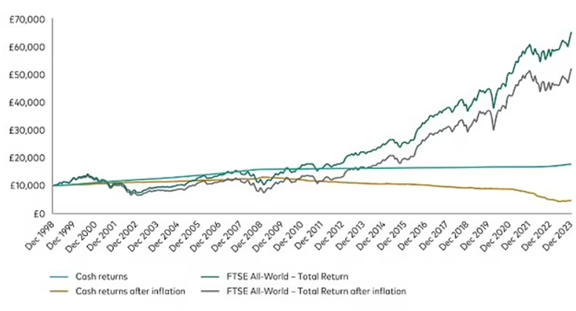

While cash feels safe, it seldom keeps pace with inflation. In the UK, returns from savings rarely match rising prices, meaning cash loses value in real terms over time. As a result, holding too much cash may risk more than holding investments.

For example, if you held £10,000 in cash savings since the start of 1999 it would have grown to over £19,000 over the past 26 years – a 90% increase, not accounting for inflation. In contrast, the same £10,000 invested in a globally diversified portfolio, represented here by the FTSE All-World Index, would have grown by more than 650% to over £75,0001.

After adjusting for inflation, the real value of the £10,000 cash savings drops to under £5,000, highlighting how inflation erodes purchasing power over time. Meanwhile, the value of the £10,000 of investments rises to nearly £65,000 when adjusted for inflation1.

Staying focused when markets fluctuate

Short-term market movements can be distracting, especially when headlines are dramatic. But reacting to temporary dips can mean missing out on the recovery. Many of the strongest market rebounds happen quickly and without warning, so sticking to a long-term plan puts you in the best position to benefit when conditions improve.

Keeping a modest cash buffer for emergencies is sensible, but letting your investments evolve through market cycles is typically the stronger route.

1 11.02.2025 Cash ISAs vs Investing This is Money

Please note:

This article is for general information only and does not constitute advice. The information is aimed at retail clients only. The value of your investment(s) and the income derived from it, can go down as well as up and you may not get back the full amount you invested. The content was accurate at the time of writing, changes in circumstances, regulation and legislation after the time of publication may impact on the accuracy of the article.

Ref; FP2025-452