5 min read

Since our last communication on 25th February, Russia’s invasion of Ukraine has continued to shock as the cost in human lives and suffering has progressively worsened as each day has passed. It is increasingly looking to be a protracted situation which will need to remain a focus for world attention and support for some time. As a result, we’ve seen continuing and increasing sanctions and a number of high-profile western firms closing or suspending their operations in Russia. This has extended into the investment world and has caused fund managers to review the extent to which they hold Russian securities – whether equities or bonds.

It is important to remember that Russia represents a small part of the global economy at around 3-4%. [1]

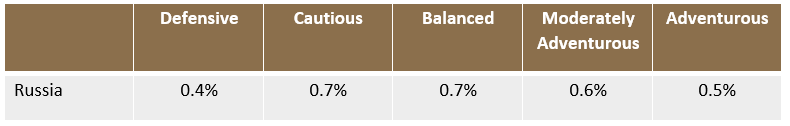

We have conducted an exercise with all the investment partners with whom we work closely, to form our Investment Matrix. The Matrix comprises of the chosen solutions we have selected for our clients from the wider market and which we monitor closely.

What we have found, is that there is an extremely small level of exposure to either Russian equities or bonds overall within our Investment Matrix. On average, holdings are considerably lower than 1%, and in the case of our sustainable portfolios and funds, there is zero exposure. In a diversified portfolio, where there are funds which hold a small element of Russian holdings, these funds will be part of broader asset allocation so the actual value as a proportion of the overall value will be very low.

As a typical example, the table below shows the proportion of Russian holdings in one of our Succession portfolio ranges:

For further information, please contact your Wealth Planner as they will be able to provide you with specific insight on any of our Investment Matrix solutions.

In the last fortnight we have seen continued volatility in world markets, in some cases this has caused the issue of a 10% ‘drop’ notification which is required when a portfolio has fallen in value by more than 10% in the quarter. We are seeing higher than usual levels of these notifications at the moment as markets have reacted to uncertainty. If you have received a notification, it should not be a cause of excess concern as market corrections and events are an inevitability of investing and, as we examined in our previous communication (click here to view) the ‘bounceback’ can often be swift.

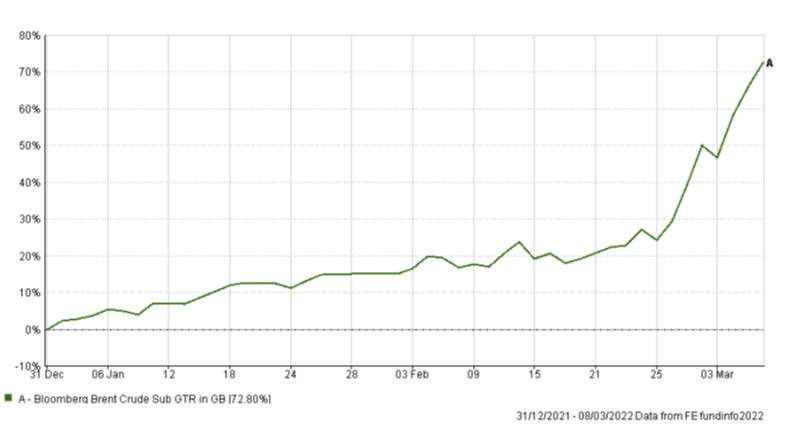

Currently a key driver for this volatility, and one which is always closely associated with geo-political issues, is the sharp increase in commodity prices – principally oil and gas. These are commodities where Russia is a major exporter to world markets producing 5-7% of global supply 1. The impact of the Russian invasion can be seen clearly below in the rate of increase of the crude oil price since 25th February:

[1] RSMR Market Update March 2022

These rises in wholesale gas and crude oil prices will in turn squeeze the cost of living as these hit daily household expenditure directly or through their effect on the supply chain for goods. This will undoubtedly add to the inflationary pressure which was building prior to the invasion of Ukraine.

Our view remains however, that despite short-term value fluctuations and market volatility, being invested is the most effective way to maintain purchasing power and offset against inflation over the long-term.

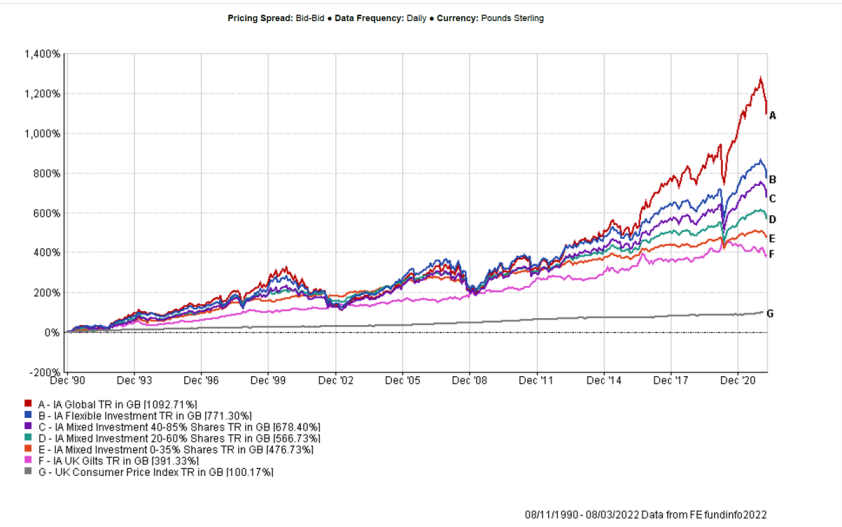

The graph below illustrates the performance of funds in comparison to the Consumer Price Index by tracking the value of £100,000 against the effects of inflation from November 1990 to present day. We have used the Investment Association (IA) Global, Flexible and Mixed sectors as they are broadly representative for the different composition and risk level of portfolios and funds in our Investment Matrix. These are compared to the Consumer Price Index to show inflation over the period.

Over the course of this period, while there have been market falls, all sectors including those which are more defensively invested with a lower proportion of shares, have been able to outpace inflation.

For further comparison, we have also included the return from UK gilts as this represents what could be considered as a risk-free return. With gilts, there is a small amount of risk as prices can change if interest rates rise or fall, but there is virtually zero risk of default and there is no investment risk. The significance of this is that it provides a benchmark of performance from which to compare returns from investments which carry risk.

In this longer-term view, we can see that in all of the investment sectors used, their performance has outpaced both inflation and the risk-free return available through gilts. We are however always mindful that past performance should not be used as an indication of future results.

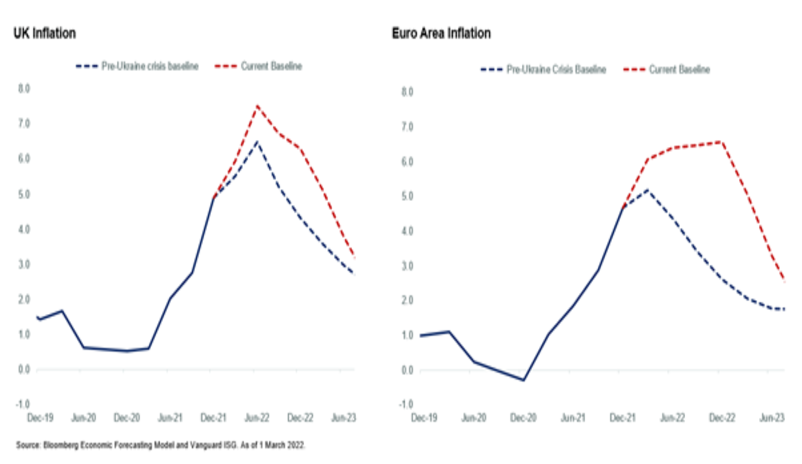

We still expect inflation to be a short to medium-term problem as we experience the current aggregated effect of supply constraints moving out of lockdown, increasing demand and commodity prices impacted by sanctions. If we look at the long-term however, we note that the Bank of England [1] and the European Central bank [2] have not adjusted their inflation targets which remain set at 2%. In an extreme situation where high energy prices persist for a while; we expect inflation to come down by 2023.

The following chart shows how forecasting is modelling the potential effect of the current crisis on the future view of inflation:

[1] Bank of England, Monetary Policy Summary, February 2022

[2] Reuters, EU exec cuts 2022 euro zone growth forecast, sharply raises inflation view, February 2022

Our view remains that by adhering to our diversified ‘all weather’ approach, our investment planning is best placed to help mitigate short-term risks and provide the best opportunity for growth in the longer-term.