4 min

Whilst the focus is predominantly on events from October, there may be reference to events and results from earlier months in the year which may be relevant or have impacted the October performance overall.

October

saw inflation continue to soar across most of the globe, with many central banks opting for sharp increases in interest rates in an attempt to bring inflation back to manageable levels. Further increases are expected through 2023, albeit in smaller increments or at a slower pace.

Stock markets showed some gains during the month, in particular in the US. Chinese stocks, however, dropped significantly in response to confirmation that leader Xi Jinping will serve a third term and the implications of staffing changes made to his top team.

Read on for a more detailed look at what happened in the global markets in October.

UK

There was more change in Downing Street in October. Jeremy Hunt was appointed to replace chancellor Kwasi Kwarteng following the economic turmoil in response to September’s mini-Budget. He reversed almost all of the tax-cutting policies announced last month1. In the same week that the reversals were announced, the FTSE 100 and FTSE 250 logged more than 1% gains2.

The subsequent appointment of new prime minister Rishi Sunak after Liz Truss’s resignation further calmed markets [3]. The FTSE 100 closed with a 0.6% gain on the Monday after Sunak was confirmed as the UK’s new prime minister4. This appointment, along with the new Chancellor’s reversal of the previous Chancellor’s much-maligned tax cuts, contributed to government bonds rallying by 3% during the month5.

Inflation continued to dominate headlines. The Office for National Statistics announced that inflation rose to 10.1% in the year to September 2022, and market predictions are that interest rates will peak at 4.75% in 20235. Fears of an approaching recession were further exacerbated by the October manufacturing purchasing manager indices, which noted a decrease in demand for goods, and in business confidence7.

US

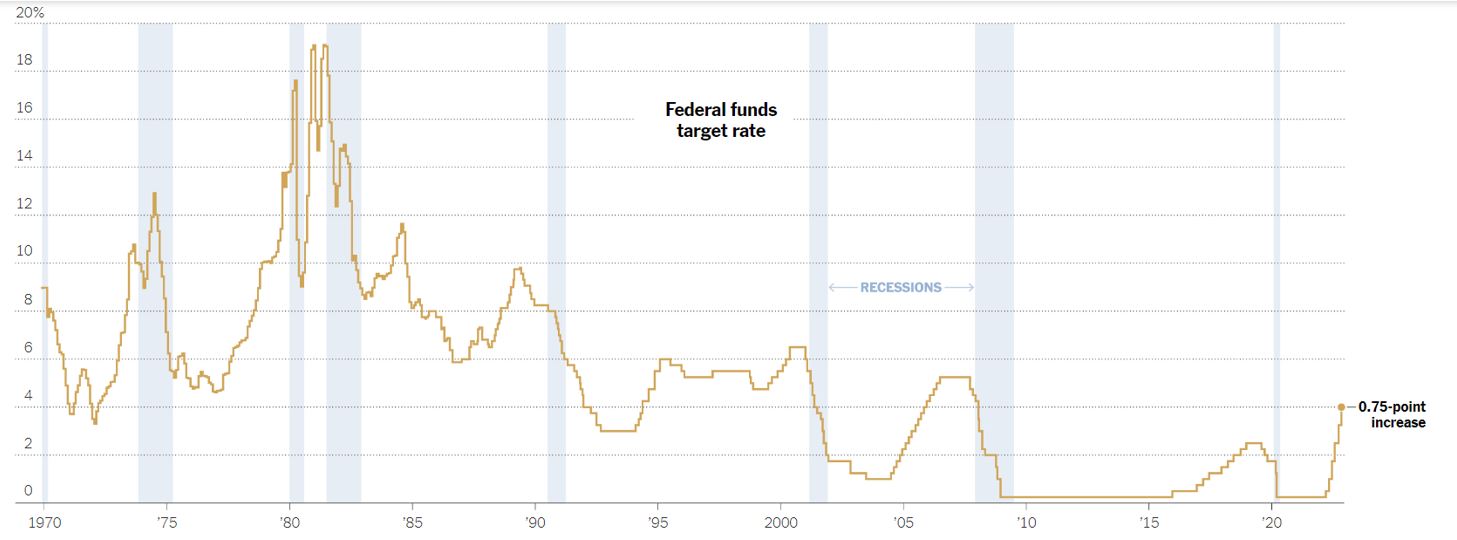

The Federal Reserve confirmed that they will continue with tighter policies in order to control rising inflation in minutes released from their September meeting8. At the beginning of November, the Fed raised the federal funds reserve by 0.75 points to between 3.75% and 4.0%, which is its fourth large rate hike in a row9. The Fed signalled that further increases are likely in the coming months but that the pace of those increases may slow to allow officials to notice the impact of the changes9.

Figure 19

Note: The rate is the federal funds rate until Sept. 27, 1982. After that, it is the federal funds target rate until Dec. 15 2008. Thereafter, it is the upper limit of the federal funds target rate range. Source Federal Reserve, by Karl Russell.

US equities made gains in October but were still down on the year to date. The S&P 500 made a gain of 7.99% in October, however at the end of October it was still down 18.76% in 202210. The Dow Jones Industrial Average gained 13.95% for the month although was down 9.92% year to date10.

The US Midterm elections took place in October with Democrats narrowly maintaining control of the Senate, and control of the House of Representatives is still undecided at the time of writing. History shows that equities tend to underperform in the runup to midterm elections and overperform following them11. Only time will tell if this is the case again in 2022.

Europe

Shares in the Eurozone made gains in October in every sector8. The pan-European STOXX 600 index had its best month of the past seven, making a gain of 4.6% across the month12. Utilities were the best performing sector, rising by over 8%12.

Inflation hit an all-time high for the eurozone in October, rising to 10.7% year-on-year according to preliminary data13. Energy and food continued to have the biggest influence on inflation; the data suggests that energy prices rose to 41.9% in the year to October 2022, and food, alcohol and tobacco prices soared by 13.1%13.

The European Central Bank (ECB) raised interest rates by 0.75% to 1.5% in October, demonstrating their commitment to controlling inflation14.

ECB president Christine Lagarde suggested that further increases are likely because inflation continues to be unacceptably high14, although it’s likely these increases will slowdown15. Some European governments have also enforced various energy price caps to limit inflation increases16.

Asia

The Bank of Japan remained one of the only central banks to not raise interest rates this month17. Inflation in Japan was measured at 3% year-on-year in September as the yen fell to a 32-year low against the dollar18 of 15019.

In China, political upheaval caused market volatility. Leader Xi Jinping made significant changes to his top team after confirming he will remain in power for a third term, causing Chinese stocks listed in Hong Kong and New York to crash and the yuan to hit a 15-year low against the dollar20 of 7.307921.

The continuation of the zero-Covid policy is also expected to have negative implications for the economy22.

What this means for you

Inflation and political upheaval continue to influence the markets, making the near future very uncertain. At times like this, it can be tempting to remove your money from what you might consider to be more risky investments or markets and instead invest in those that feel more familiar or safe.

In uncertain times, it’s vital to remember one of the key pillars of Succession’s investment philosophy: diversification. When you diversify your assets and invest in a wide variety of sectors and markets, you may be able to help to protect your wealth from the sorts of downturns we’re currently seeing. A well-diversified portfolio may mean any negative returns in certain markets can be balanced by other investments which may be showing positive returns.

Alongside diversification, remember that your investments are normally intended to be for the long term. Monthly fluctuations in value are part and parcel of being invested in the stock market, and the price you pay for potentially superior long-term growth.

Sources:

117.10.22 | New UK finance minister Hunt reverses Truss's economic plan in dramatic U-turn | Reuters

2 21.10.22 | FTSE 100 ends higher on boost from commodity stocks | Reuters

3 02.11.22 | How Will U.K.’s New PM Rishi Sunak Help the Stock Market? | Forbes

4 24.10.22 | FTSE 100 Closes Up 0.6% After Rishi Sunak Confirmed as UK Prime Minister | Morningstar

5 01.11.22 | Monthly Market Review | JP Morgan

6 19.10.22 | Consumer price inflation, UK: September 2022 | Office for National Statistics

7 October 2022 |United Kingdom Manufacturing PMI Trading Economics

8 03.11.22 | Monthly markets review - October 2022 | Schroders

9 02.11.22 | Fed Makes Fourth Jumbo Rate Increase and Signals More to Come | The New York Times

10 02.11.22 | U.S. Equities Market Attributes October 2022 | S&P Dow Jones Indices

11 09.11.22 | What Could Midterm Elections Mean for the Stock Market? | Morningstar

12 29.10.22| European shares end flat, but add nearly 5% in October on strong earnings | Reuters

13 31.10.22| Euro zone inflation hits record high of 10.7% as growth slows sharply 2| CNBC

14 27.10.2022 | European Central Bank hikes interest rates, fuelling recession fears | The Guardian

15 31.10.22 | Eurozone Inflation Rate Rises to 10.7% as Recession Looms | The Wall Street Journal

16 26.10.22 | Energy bills are soaring in Europe. This is what countries are doing to help you pay them | Euronews

17 27.10.22 | Bank of Japan sticks to its dovish stance as the rest of the world takes on jumbo hikes | CNBC

18 21.10.22 | Japan's inflation hits 8-year high in test of BOJ's dovish policy | Reuters

19 20.10.22 |Japanese Yen Hits 150 a Dollar, a 32-Year Low, Even as Tokyo Warns of Possible Intervention | The Wall Street Journal

20 26.10.22 | Xi Jinping just became unassailable. Here’s why investors are running scared | CNN

21 25.10.22 | Chinese Yuan Hits 15-Year Low on Political Jitters, Weak PBoC Fix | Yahoo

22 02.11.22 | China – what now for investors? | Schroders

Please note: This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The content of this guide was accurate at the time of writing.

FP2022-386