5 min read

November was a relatively positive month for stock markets, as central banks around the world appeared to be slowing or pausing interest rate hikes. With inflation falling in most major economies, investor optimism seemed to increase.

US

The Consumer Prices Index showed headline inflation fell to 3.2% year-on-year in October but remained flat compared to the previous month . The flat monthly reading is attributed to a 0.3% rise in food prices offsetting a drop of 2.5% in energy prices1. This suggests that price rises are moderating, which could enable the Federal Reserve to end the current campaign of interest rate hikes1.

Fed chair Jerome Powell announced that policymakers were unsure if enough has been done to bring inflation back to its 2% target, so rates are likely to be held steady until more data is available2.

The US economy showed signs of slowing in November, as retail sales data showed that consumers reduced their spending in October for the first time since March3.

Despite this, the falling inflation figures created optimism on the stock markets. The S&P 500 index rose by 9% for the month and the Nasdaq Composite returned 11%4.

UK

Inflation fell to 4.6% year-on-year in October, its lowest level in two years, as a result of falling gas and electricity prices5. Economists had predicted that inflation would fall to 4.8%, showing that the rate is slowing more quickly than expected5.

Falling inflation led many to believe that the Bank of England will continue to hold interest rates steady rather than raising them further. The Monetary Policy Committee held rates steady at 5.25% at their meeting in November6, and many expect it will stay at this level in December, following the fall in inflation7.

The chancellor of the Exchequer delivered his Autumn Statement in November, announcing a cut in the main rate of National Insurance from 12% to 10%, raising the legal minimum wage, and increasing the State Pension by 8.5% from April 20248.

He also announced a freeze on alcohol duty until August 2024, which led shares in pubs to rally on the day of the statement9. Overall, though, markets reacted negatively, with the FTSE 100 falling 0.4%9.

The UK economy is showing signs of growth after flatlining in Q2 this year; services output increased by 0.5% and manufacturing output rose by 3% in the three months to September compared to the same period last year10.

The UK blue-chip FTSE 100 gained 1.4% for the month, despite falling 1.1% over the past year11. The FTSE All-Share rose 3% in November, bringing its year-to-date earnings to 3.3%12.

Europe

Inflation in the eurozone fell to 2.4% in November, below economists’ expectations, driven by an 11.5% fall in energy prices for the month13. This was offset by a rise in food, alcohol, and tobacco prices of 6.9%13.

Despite this, policymakers at the European Central Bank (ECB) cautioned that the drop from the current level to its 2% target could prove even more challenging14. The ECB seems unlikely to reduce rates any time soon, after President Christine Lagarde said in October that "even having a discussion on a cut is totally, totally premature"15.

Despite a downturn in economic activity in the eurozone in October, European stock markets performed well during November16. The MSCI Europe ex-UK Index rose by 7% over the month, driven in part by the financial sector, which benefited from stronger interest margins and profits12.

Asia

After a disappointing year, November saw a second consecutive monthly contraction for the Chinese economy and at a faster pace as a result of lower-than-expected economic output17. Geopolitical tensions, the property market, and slow global growth have all weighed on the economy this year after hopes that the relaxation of Covid rules in late 2022 would lead to a post-pandemic recovery17.

Talks between the presidents of the US and China went well in November, with the two countries coming to agreements on subjects such as military communication and climate change18. Biden described the talks as “some of the most constructive and productive discussions we’ve had”19 and tensions could be eased as a result12.

Asian stock markets performed well in November. The Japan TOPIX index rose 5.4% for the month, bringing its year-to-date returns to 28.6%, while the MSCI Asia ex-Japan returned 7% for the month and 2.7% year-to-date12.

What this means for you

When global events create uncertainty on the stock markets, it can feel as though you need to respond with action. It’s often uncomfortable to watch volatility affect your portfolio.

So far this year, the Japan TOPIX index has been the top performer of the major global equity markets, returning 28.6% year-to-date12. The next highest-performing equity market has been the S&P 500, returning 20.8% for the year.

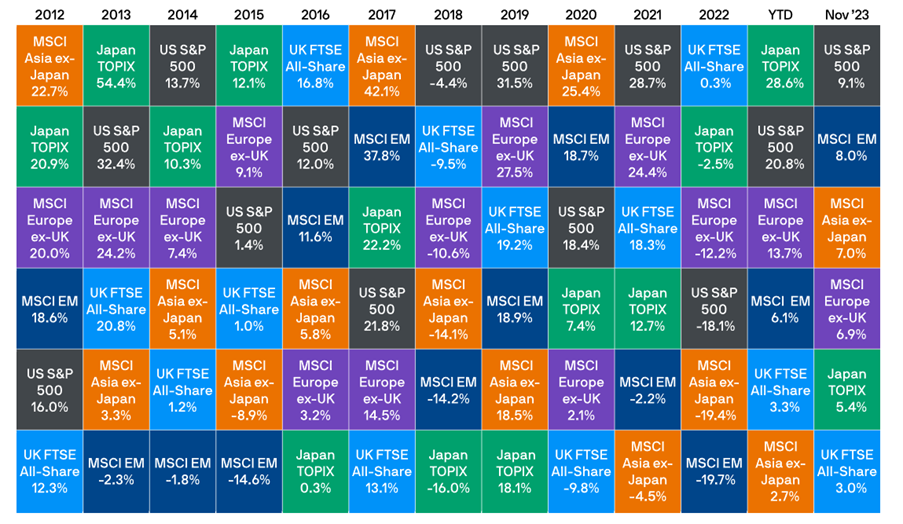

When an index performs well over the course of a year, it can be tempting to move more of your investments into it. Think carefully before doing so though, since past performance does not guarantee future performance.

In fact, if you look back at the annual returns of the past 10 years, you’ll notice that none of the indexes are consistently outperforming any others.

World stock market returns from 2012 – 202312

Succession Wealth Limited is a trading style of Succession Wealth Management Limited, which is authorised and regulated by the Financial Conduct Authority. Financial Services Register number 588378.

Succession Wealth Management Limited is registered in England at The Apex, Brest Road, Derriford Business Park, Derriford, Plymouth PL6 5FL: Registered Number 07882611.

Please note: This guide is for general information only and does not constitute advice. The information is aimed at retail clients only.

The content of this guide was accurate at the time of writing. While information is considered to be true and correct at the date of publication, changes in circumstances, regulation, and legislation after the time of publication may affect the accuracy of the guide.

Sources

1 14.11.2023 Inflation was flat in October from the prior month, core CPI hits two-year low | CNBC

2 01.11.2023 | Fed keeps rates unchanged, Powell hedges on possible end of tightening campaign |Reuters

3 15.11.2023 | US retail sales fell in October for the first time in seven months | CNN

4 01.12.2023 | Stocks just had their best month of 2023. Here's what drove the November rally | Business Insider

5 15.11.2023 | UK inflation drops sharply to 4.6% as energy prices fall | The Guardian

6 02.11.2023 | Monetary Policy Report - November 2023 | Bank of England

7 15.11.2023 | UK inflation drops sharply to 4.6% as energy prices fall | The Guardian

8 22.11.2023 | Autumn Statement 2023: National Insurance and more key announcements by Jeremy Hunt | BBC

9 22.11.2023 | VIEW UK markets sapped by Hunt's budget | Reuters

10 20.11.2023 | Economic Indicators | House of Commons Library

11 30.11.2023 | Where will the FTSE 100 finish 2023? | Yahoo Finance

12 01.12.2023 | Monthly Market Review | J. P. Morgan

13 30.11.2023 | Euro zone inflation sinks to 2.4%, below expectations | CNBC

14 30.11.2023 | Euro zone inflation tumble pits ECB against markets | Reuters

15 14.11.2023 | ECB to hold rates through mid-2024 despite stalling economy - Reuters poll | Reuters

16 06.11.2023 | Euro zone recession fears harden | Reuters

17 30.11.2023 | China's factory activity extends declines in November | Reuters

18 16.11.2023 | Five things we learned from the Biden-Xi meeting | BBC

19 16.11.2023 | Biden hails productive talks with Xi as agreements reached on fentanyl and military communication | CNN

FP2023-533